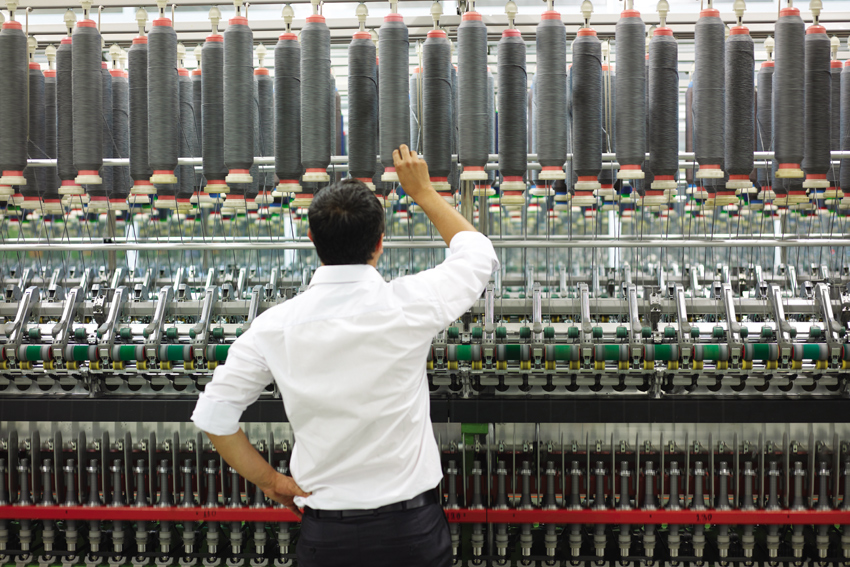

While the much celebrated Egyptian cotton has fallen from grace in recent years, elsewhere the textiles industry has been truly blossoming. Now representing 20% of manufacturing exports, the sector is buoyed by an initiative that has both helped increase trade with the U.S. and improve relations with Israel .

The label “Egyptian cotton” on a set of bed sheets evokes sweet dreams of luxurious softness. Indeed, Egyptian cotton was once the bar against which all other linens and clothing were measured.

So sought-after was it that some said Egyptian cotton was as much a symbol of Egypt as the Pyramids of Giza.

“Egypt has had a long history of textile manufacturing and we have one of the best cottons in the world,” says Mohamed Kassem, Chairman of the Ready Made Garment Export Council, a public-private partnership between the Ministry of Trade and Industry and some of Egypt’s most prominent clothing exporters.

But since the 2011 revolution, Egyptian cotton’s star has faded as cash subsidies from the government and output of premium cotton have shrunk.

Yet as production of Egyptian long-fiber cotton has fallen – from a high of nearly 2.5 billion bales in 1970 to just 340,000 today, according to the U.S. Department of Agriculture – the textiles market has been blossoming.

Exports of textiles and ready-made garments (RMG) have reached $2.5 billion, and the sector generates around one in three jobs in more than 4,400 companies around Egypt.

Mr. Kassem says the sector has its sights set on even more growth, driven by exports to Egypt’s two biggest markets for textiles and RMG; the United States and the European Union.

“Our goal is to increase from the $2.5 billion in exports that we are currently producing to $10 billion by 2025,” he asserts.

With the international market projected to double in the next 10 years from $350 billion to $700 billion, Mr. Kassem adds, “It will not be difficult to reach our goal if we do our job right.”

Part of doing the job right involves changing with the times and producing garments and textiles with other materials besides Egyptian cotton, explains Mr. Kassem, who spent years in the foreign service – including a stint at the Egyptian embassy in Washington, D.C., as the commercial attaché in charge of promoting Egyptian exports.

“Our Egyptian cotton is what they call the ‘extra-long staple.’ The demand for this type of cotton does not exceed 3-4% of the total demand of all fibers. To be a major player, other fibers including short staple cotton must be used.”

Egypt will not completely abandon the luxury cotton that bears the nation’s name, but the industry has realized that “you cannot use an expensive Egyptian cotton to produce cheap yarn,” affirms the Ready Made Garment Export Council chairman.

And that’s the way the market is going, according to Mr. Kassem. “To be a player in this market, you need to play the game that everyone is playing.”

Last year, around one third of Egyptian textile exports and more than half of Egyptian ready-made garments went to the United States.

Textile exports to the United States represent a quarter of non-oil exports and 20% of total manufacturing in Egypt.

Playing a large part in Egypt’s success in the U.S. market are the 15 Qualifying Industrial Zones (QIZ) in the country.

Companies in QIZ can export goods to the United States duty-free, provided at least 35% of the product they sell is manufactured in a qualifying zone and 10.5% of the product or its component parts are made in Israel.

Waleed El Zorba, the Chairman of the Nile Clothing Company, says QIZ was “a life-saver for my company.”

“Asia was so cheap, and they had so much capacity that if I didn’t have that competitive edge, I wouldn’t have been on the map.”

But because of the advantages that come with operating in a QIZ, “We really stood out and we offered a lot of value to the importers and retailers,” continues Mr. El Zorba.

According to the Egyptian Trade Ministry’s QIZ website, exports from Egypt have risen sharply since QIZ began, “with the bulk of these exports going to US markets.”

Mr. El Zorba says there’s an attraction to doing business with American companies that is hard to find elsewhere.

“Europe is very segmented. England is buying for England; France is buying for France, so the order quantities shrink accordingly,” he explains.

“When you sell to Walmart, you are selling to 3-4,000 of the biggest stores in America. Or if you sell to Levi’s, they are selling to all of the department stores across America.”

Mr. Kassem agrees that Egypt’s QIZ has had a huge, positive impact on business. But, he adds, it has also enhanced Egypt’s relations with one of its neighbors.

“Through QIZ, we are now duty-free exporters, but there is also a political initiative, which brings Israelis and Egyptians together in business. In my opinion, this is one of if not the only political initiative that has paid back,” he says.

Mr. Kassem adds, however, that it has been a struggle to maintain double-digit growth that the textile and RMG sector was enjoying before the 2011 revolution.

Not only have government subsidies for luxury, long-fiber cotton dried up, but so did some customers’ confidence.

“We are holding our ground at a very high cost with a lot of hard work to keep our customers from leaving. In the first days of the revolution, we were sending out situation updates so that they didn’t rely on Fox News to hear what was happening,” Mr. Kassem says.

Mr. El Zorba admits “I was actually spending almost every other month traveling to New York to let people know that our ports are open, business is running, there would be no stop in flow, and don’t pay attention to everything you are seeing on the news.”

His company never missed a delivery to clients, even at the height of the revolution. “But that took about a year for them to realize,” he says.

Today, Egyptian textile and RMG companies are beginning to turn the corner, and Mr. Kassem is urging Americans to continue buying made-in-Egypt clothing and textiles.

“Garments out of Egypt are seeking customers in the U.S. Every garment you buy from Egypt is a vote for democracy.”

0 COMMENTS