Four main pillars underpin Chile’s appeal as a destination for foreign investment: political and economic stability, a wide network of international trade agreements, legal security and stability, and a high standard of transport and communication services.

Its tax-friendly environment has also caught investors’ eyes. According to the Ministry of Foreign Affair’s International Economic Relations Office (Direcon), the corporate income tax rate is 17% (temporarily increased to 20% in 2011 and 18.5% in 2012 to help finance Chile’s earthquake reconstruction program), which is one of the lowest corporate income tax rates in the world. It also has bilateral agreements with 22 countries to avoid double taxation, with others to be soon ratified.

In 2010 Chile formally became the first South American country to enter the Organization for Economic Cooperation and Development (OECD). Acceptance as the 31st member of the organization marked international recognition of two decades of democratic reform and sound economic policies in Chile.

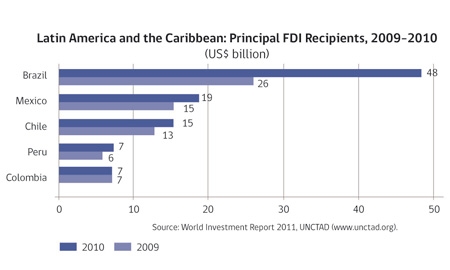

Unsurprisingly, Chile has seen a boom in foreign direct investment (FDI), which has quadrupled over the past seven years, totaling US$15 billion in 2010. FDI has been running at 6.5% of the country’s gross domestic product and more than 5,000 companies from 60 countries around the world have set up shop here.

This growth in FDI has helped to bolster Chile’s competitiveness not only through resources and new markets, but also through technological development. Modern Chile is a crucible of innovation, renewable energy and services, which now account for 60.5% of FDI.

In January 2009, Wal-Mart acquired 58.2% of Distribucion y Servicios (D&S), Chile’s leading supermarket chain – one of the largest U.S. investments in Chile outside the mining sector. Wal-Mart’s biggest investment ever in Latin America was a significant vote of confidence in Chile and gave the retail giant a strategic position in the continent.

0 COMMENTS