With its economy heavily oriented towards exports, Malaysia has been taking huge encouragement from recent trade figures, which show clear signs of recovery from the setback caused by the global economic crisis.

Total trade for the country rebounded last year, surpassing the RM1 trillion mark to register a value of RM1.169 trillion (around £244 billion). That is close to the 2008 pre-crisis level, and represents 18.3 per cent growth after a 16.5 per cent decline in 2009 following the slump in worldwide demand for consumer goods.

Exports surged by 15.6 per cent to RM639.43 billion (£133 billion) in 2010, and while imports increased by 21.7 per cent to RM529.19 billion (£110 billion), there was still a healthy trade surplus of RM110.23 billion (£23 billion).

Even better results are forecast for this year. International Trade and Industry Minister Mustapa Mohamed predicts an export expansion to RM700 billion (£146 billion), an increase that would meet the 10th Malaysia Plan target of 10.6 per cent.

“So far this year, the total trade performance has been quite good with a 10 per cent increase in the first four months compared with the same period last year,” he says.

The improvement is largely due to higher sales of electrical and electronic products, refined petroleum products, palm oil, and crude rubber, as well as chemicals and chemical products.

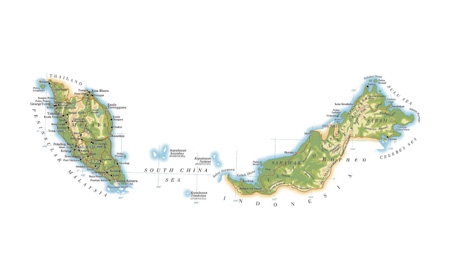

Malaysia’s top five export destinations are Singapore, China, Japan, the United States and Thailand. The country benefits from free trade agreements (FTAs) between the Association of Southeast Asian Nations (ASEAN) and India, Australia and New Zealand that came into force at the beginning of this year. It has also been actively seeking bilateral FTA agreements.

A bilateral deal with New Zealand took effect last year and negotiations with Chile and India have also been successfully concluded. Talks about bilateral FTAs with Turkey and the European Union are under way.

Malaysia became a full negotiating partner in the Trans-Pacific Strategic Economic Partnership last year. It is also exploring non-traditional and emerging markets, such as the Middle East and North Africa.

Foreign direct investment in Malaysia rose by more than 400 per cent in 2010 to RM29 billion (around £6.05 billion) from £1.06 billion in 2009.

In June, Mr Mustapa announced that FDI for the second quarter of this year amounted to RM11 billion (£2.3 billion). The Minister said he was confident Malaysia would surpass or at least equal last year’s figure of RM29 billion. He believes the country is on track to achieve its target of attracting FDI of RM1.4 trillion (£292 billion) to the country by 2020.

Investments in the manufacturing sector, which accounts for the largest share of exports, increased to RM47.18 billion (£9.84 billion) last year compared with RM32.64 billion (£6.8 billion) in 2009, with 910 projects compared with 766 projects in 2009. Malaysia’s electrical and electronics sector in particular has attracted significant investment and is expected to remain a major contributor to the country’s export growth as global demand for semiconductor devices increases.

The services sector, led by the wholesale and retail trade, and the communications and finance and insurance sectors, is regarded as a prime growth engine for the Malaysian economy. This year its contribution to GDP is predicted to rise to 58 per cent; by the end of the 10th Malaysia Plan, this is expected to increase to 61 per cent.

The recent renaming of the Malaysian Industrial Develop-ment Authority as the more relevantly titled Malaysian Investment Development Authority (MIDA) reflects its expanded role and scope. MIDA has been given full empowerment to make decisions expeditiously and to co-ordinate all other investment promotion agencies for the manufacturing and services sectors. The approvals process has been streamlined and decisions are being made faster through its National Committee on Investment (NCI).

“It’s a competitive world,” says Jalilah Baba, MIDA’s director general. “There are more countries with emerging economies, and new economies are popular because when things are opening up, they are visible to everybody. Malaysia, on the other hand, has been open for quite some time now; we started our industrialisation in the 70s. Consequently, our challenge is to get the investors we want on board to get to know us.”

Malaysia is ranked 26th out of the 139 economies in the World Economic Forum’s Global Competitiveness Report for 2010-2011, and 21st in the World Bank’s latest Doing Business report. Mrs Jalilah enumerates the country’s strengths, including “our political stability and the fact that we are very strong economically. The Government is supportive of business and is moving ahead in terms of increasing efficiency through its transformation programmes.”

Nazri Aziz, Minister in the Prime Minister’s Department in Charge of Law and Parliamentary Affairs, points out that Malaysia also has the advantage of having a judicial system similar to that of the UK. “Our laws are based on the British system, which has been around for hundreds of years and is known all over the world. Foreign investors know that they will be treated fairly in countries with good judicial systems,” he says.

0 COMMENTS