Despite facing challenging times due to low oil prices and economic uncertainty, Qatar’s top financial institutions have not let their vital corporate social responsibility programs suffer

As Qatar continues to grow into its role as an international financial hub, leaders at the nation’s most important financial institution in the country say they are bringing a renewed focus to corporate social responsibility (CSR) programs in areas such education, the environment and sustainability, in line with the government’s National Vision 2030.

Investing in education and training

Ali Ahmed Al-Kuwari, Group Chief Executive Officer of Qatar National Bank, says that investment in education is integral to Vision 2030, which aims to diversify the emirate’s economy and make it less dependent on hydrocarbon resources.

“The central theme of [this program] is the creation of a knowledge-based economy, where growth is driven by a productive and innovative workforce. Education is a crucial element towards realizing this vision through the development of skilled human capital,” says Mr. Al-Kuwari.

Through its CSR programs in education and training, Mr. Al-Kuwari says that QNB is supporting the goals of Vision 2030. For example, the bank has recently partnered with Teach for Qatar, a teaching and leadership development program that places teachers in public schools.

“QNB will endorse Teach For Qatar’s mission and vision through funding and networking opportunities. We will also support the Teach For Qatar program by offering its employees the opportunity to join the Teach For Qatar Fellowship,” says Mr. Al-Kuwari.

QNB has sponsored a number of other education initiatives, including study abroad programs and career fairs around Qatar. It has also recently signed a memorandum of understanding (MoU) with the Qatar Banking Studies and Business Administration Independent Secondary School for Boys (QBSBAS) to help train the school’s students across the bank’s divisions.

Another financial institution that is supporting education programs aimed at promoting “knowledge-based” growth is QInvest.

“Obviously, [our] sector is very much human capital driven, and we are committed to supporting the communities in which we operate,” says QInvest’s CEO, Tamim Al-Kawari.

“During 2015, we launched several corporate social initiatives, further committing to developing the industry and supporting the communities in which we operate. We signed an MoU with Carnegie Mellon University in Qatar (a branch of Carnegie Mellon University in Pennsylvania) to cooperate in the fields of research and education, and for the second consecutive year the bank welcomed a group of graduates from the Executive Master’s Program in Islamic Finance from Paris Dauphine University,” he adds.

Furthermore, through its QTalent internship program, QInvest offers recent graduates and final-year undergraduates the opportunity to work in a leading Islamic financial institution, with a diversified and challenging working environment.

Qatar Stock Exchange (QSE) is also investing in education programs to support Vision 2030. CEO Rashid bin Ali Al-Mansoori recently said that the QSE is keen to partner with Qatari universities as part of its CSR strategies to ensure linkage between academia and the finance industry.

“In line with the human, economic and social pillars of the Qatar National Vision 2030, QSE is keen to cooperate with the Qatari universities in development and training programs designed to help the link between educational output and the professional life,” Mr. Al-Mansoori told deans and professors of Qatari business and economic faculties at an event in June.

QSE has also introduced a number of career and social development programs for its staff across all levels.

“We take our responsibilities in the spheres of social and human development very seriously, ensuring that we provide support to our staff, members and investors through initiatives in education and social awareness,” adds Mr. Al-Mansoori.

“We are also active, through programs with our listed companies, in promoting environmental awareness and sustainability, encouraging them to keep investors aware of their efforts and providing regular reports on their activities.”

Green banking

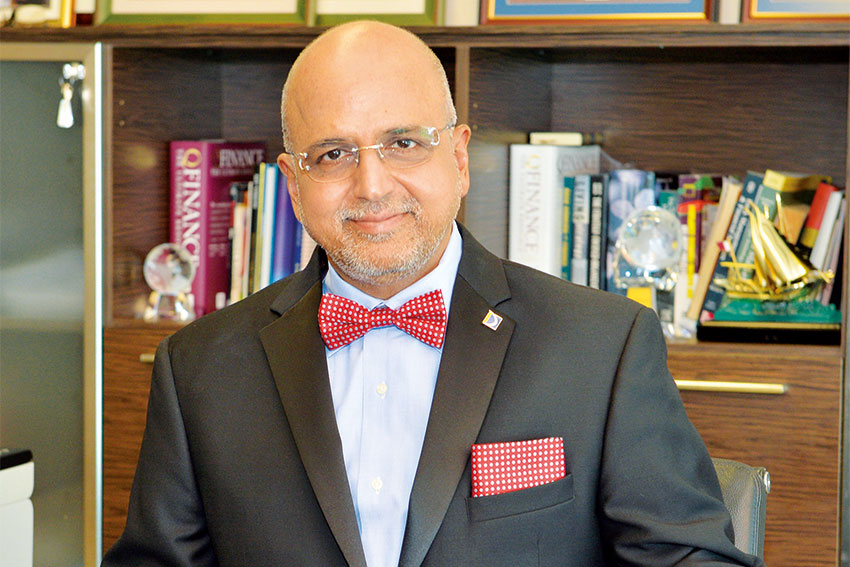

Like QSE, Doha Bank has been particularly outspoken on environmental awareness and sustainability, mainly through its CEO Dr. Ragharan Seetharaman, who is internationally renowned for his activism in this area.

“When it comes to environmental development, we were the first bank in the Gulf to start talking about green banking. As a matter of fact, we did it 15 years before the green mission started and we are currently part of the global governance summit,” says Dr. Seetharaman.

The Doha Bank executive last year received a doctorate degree in green banking and sustainability from Sri Sri University in India. During his thesis defense to the examining board, Dr. Seetharaman argued, “Green banking promotes environment-friendly practices and reduced carbon footprint from banking activities. The global financial crisis has made me rethink on green banking. Banks, as socially responsible citizens, should earmark capital for green banking apart from capital for regulatory requirements.”

He urged banks to “earmark a minimum 10% of tier 1 capital subject to a cap of 10% of risk-weighted capital towards green banking or clean development mechanism (CDM) or any sustainable development projects taking into consideration the carbon emissions prevailing in the economy in which the bank operates.”

More recently, in May of this year, Dr. Seetharaman received the Green Economy Visionary Award at the Union of Arab Banks (UAB) International Banking Summit in Rome. At the ceremony he highlighted the green banking initiatives undertaken under his leadership at Doha Bank.

“Doha Bank has promoted paperless banking, internet banking, SMS banking, phone banking and ATM banking, as well as online channels such as Doha Souq, e-remittances and online bill payments. It has launched its green credit card and green account. It also has a dedicated green banking website which integrates the bank’s initiatives in promoting environmental safety with the community by reaching out to both the public and private sectors,” he said.

Under his leadership, Doha Bank has also helped to finance some of Qatar’s most important green energy developments, such as the construction of Qatar General Electricity & Water Corporation’s water security mega reservoirs project.

“We support projects which encourage climate change mitigation and promote sustainable development,” says Dr. Seetharaman. “We have supported all this within the scope of Qatar’s four pillars for development. All this pillars have to converge in substance so that long-term sustainable growth can be ensured for the economy and for its people.”

Award-winning humanitarian work

Commercial Bank of Qatar is another bank that sees CSR programs as integral to its business. In December the bank won the Best CSR Report award at the corporate social responsibility awards ceremony in Doha. The bank was praised for performing a number of humanitarian and CSR activities over the past three years, including humanitarian projects and charitable work for the disadvantaged; educational, training and personal development programs for Qatari youth; sports and health initiatives; and support for Qatari arts.

On receiving the award, former CEO Abdulla Saleh Al-Raisi (who was replaced in July by Joseph Abraham) said, “Commercial Bank regards CSR as integral to its business in support of Qatar’s national development in line with the Qatar National Vision 2030. Commercial Bank strives to be an outstanding corporate citizen by supporting local and international socio-economic initiatives that benefit Qatari society as a whole, and we consider this award to be the crowning achievement of our CSR strategy.”

0 COMMENTS