During the most recent recession, Uruguay has remained shielded from the worst of it thanks to the government’s prudent macroeconomic policy, which has made the country less vulnerable to external pressures.

“We’re convinced that the sustainability of the fiscal policy is one of the most important tools in ensuring both a healthy business climate and full observance of the rules of the game in the economy, key elements for promoting investment,” explains Economy Minister Fernando Lorenzo.

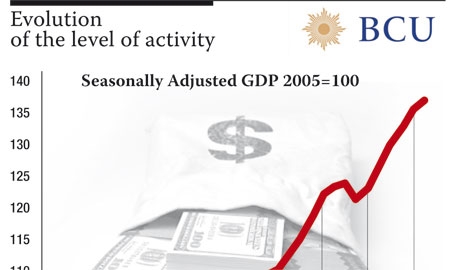

Economically, growth in the South American country has remained strong throughout the past 60 years, posting average annual growth of 1% between the 1950s and the 1990s. In 2010, in the face of the global economic crisis, Uruguay’s GDP grew a robust 8%, according to the Economist Intelligence Unit, who predicts a deceleration to 4.3% for the current year.

Mr. Lorenzo also foresees steady growth for the medium term. “There are firm foundations in place for Uruguay to continue growing at an annual rate upwards of 4% over the next five years,” he says. “We believe the strong investment process and the success that many productive sectors are enjoying in international markets may drive these rates even higher over the next few years.”

Many U.S. investors have taken notice of Uruguay’s political and economic stability, as well as its incentives and attractions, such as strict observance of the rule of law, its vast wealth of natural resources – which lend themselves not only to exploitation but also to tourism – and its highly educated and skilled workforce. Moreover, Uruguay does not discriminate between national and foreign investors.

The U.S. and Uruguay maintain excellent business relations based on two treaties: the investment protection treaty and the Trade and Investment Framework Agreement, or TIFA. “We aspire to improve access to the North American market and in fact, the work being done with the U.S. government with the TIFA is heading us in the right direction, helping us find the right mechanisms to increase market access for our products,” comments Mr. Lorenzo.

From January through October 2010 U.S. trade with Uruguay, who ranked 33rd on the Heritage Foundation’s Economic Freedom Index, reached nearly one billion dollars.

0 COMMENTS