Qatari banks enjoyed asset and profit growth in 2015, despite the challenging global economic conditions and regional volatility. Analysts warn that Qatari banks face tightening liquidity and weaker credit growth, however the Qatar Central Bank says it will “continue to actively manage liquidity” to keep credit flowing to the real economy

During the years of high oil prices, Qatar’s banks successfully surfed the wave of profitability. They funded numerous projects. They were awash with cash. They made acquisitions and grew their presence abroad.

Then came June 2014 and the nosedive of the price of oil, the backbone on which many a Middle Eastern economy is built. From $115 per barrel, oil plunged 70% to less than $35 a barrel by February 2016. This sharp fall in oil prices coincided in Qatar with a ramping up of infrastructure projects, including the construction of the Doha metro system, several highways, and stadiums that will be used for the FIFA World Cup in 2022. The intersection of the two – stepped up spending on infrastructure projects and sharply lower oil prices – brought a warning from International Monetary Fund (IMF) Director Christine Lagarde for Qatar and other Gulf states to do some belt-tightening.

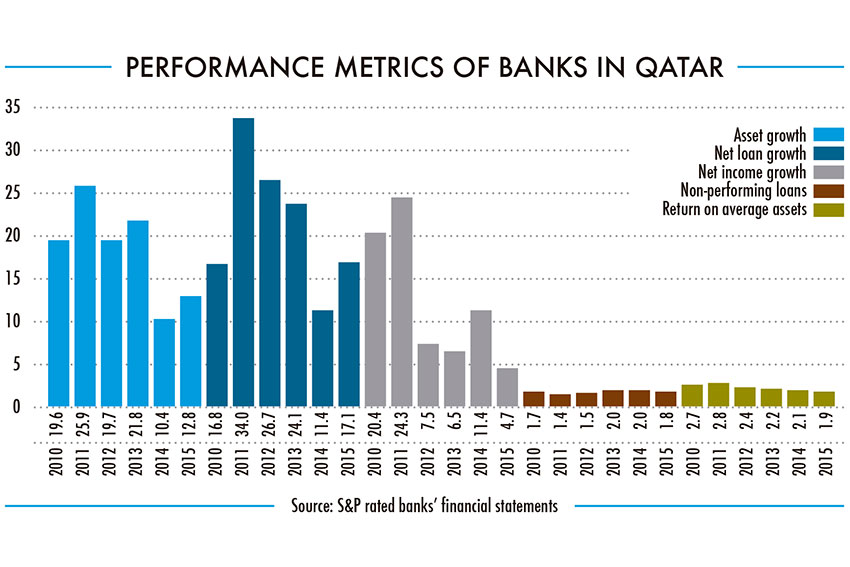

Standard & Poor’s warned in a report published this year that Qatar’s banks are likely to face tightening liquidity, weaker credit growth and lower profits this year, partly because of the fall in oil prices and a reining in of the government’s public investment program. But, the report said, Qatari banks’ asset quality has held steady, and credit growth has shown resilience, thanks to strong private sector activity in 2015.

“We think banks will manage their funding profiles more conservatively, which should translate into lower growth. We also expect credit losses will increase given the economic slowdown and the pressure we expect in some sectors, such as contracting,” said Standard & Poor’s Director Fevzi Timucin Engin in a recent interview.

Heeding the warnings, Governor of the Qatar Central Bank Sheikh Abdullah bin Saud Al-Thani says that the QCB “will continue to actively manage liquidity in the system in order to ensure a stable interest rate environment and thereby facilitate an adequate flow of credit to the productive sectors of the economy.”

Optimism

Commercial Bank of Qatar CEO, Joseph Abraham remains optimistic about the banking sector and the economy as a whole. He says that that while economic growth in Qatar has “indeed slowed a bit…we are still witnessing robust economic growth in our economy.”

He adds, “Qatar will spend nearly $200 billion over the next decade on infrastructure projects as we move close to the FIFA 2022 World Cup. Despite the fall in oil prices, Qatar’s Minister of Finance has stated that it will be business as usual in terms of these projects’ execution. Commercial Bank remains strongly committed to supporting and financing the development of these major infrastructure projects.”

Ali Ahmed Al-Kuwari, Group CEO of Qatar National Bank (QNB), shares Mr. Abraham’s optimism: “The recent fall in oil prices will only have a minor impact on the strong diversification drive of the Qatari economy. The Qatari economy will continue to grow on the back of strong public and private investments to diversify the economy away from the hydrocarbon sector. As a result, the banking sector will continue to benefit from these strong tailwinds, with double digit-growth in assets and deposits.

“Solid profitability is supported by high asset quality (five-year average non-performing loans of 1.8%) despite high capital buffers with a five-year average capital adequacy ratio of 17.6%.”

Mr. Al-Kuwari put part of the banking sector’s stability down to a traditionally conservative approach to lending.

“This engenders a strong risk governance mentality, generates a clear definition of risk appetite, and promotes prudent risk management at consolidated and local levels,” he says. “Caps on consumer credit limit and tight lending standards have kept the risk of excessive private sector leverage contained with conservative loan-to-value ratios for specific products.”

Assets and profits up

Despite the uncertain political and economic global backdrop, the majority of Qatari banks kept shareholders happy by recording a rise in assets and profits in 2015.

QNB Group’s net profit in 2015 rose to QAR 11.3 billion ($632 million), up by 8% compared to 2014, while total assets increased by 11% to reach QAR 539 billion, the highest it has ever achieved.

CEO of Doha Bank, Dr. Raghavan Seetharaman, notes that his bank recorded net profits for the first quarter of 2016 of QAR 354 million. Total assets increased from QAR 74.2 billion at the end of Q1 2015 to QAR 84.7 billion as of March 31, 2016, representing a year-on-year rise of 14.2%.

Deposits also showed a year-on-year increase of 13.7%, from QAR 45.2 billion to QAR 51.4 billion. Dr. Seetharaman says this increase in deposits was “evidence of the strong liquidity position of the bank.”

He also notes that Doha Bank has achieved a rate of return of 1.69% on assets, “which is a clear demonstration of the effective utilization of shareholders’ funds and optimum asset allocation strategies.”

QNB, Commercial Bank and Doha Bank are amongst the largest of Qatar’s 14 conventional banks. The country also has four Islamic banks, including Qatar Islamic Bank (QIB), the country’s first. According to Ernst & Young, global Islamic banking assets grew at an annual rate of 17.6% between 2009 and 2013.

Bassel Gamal, Group CEO of QIB, says that strong growth is “predicted to continue into the foreseeable future.”

QIB enjoyed profits of QAR 1.95 billion for the year 2015, which represented a strong 22% increase over 2014.

Another Islamic lender, Masraf Al Rayan, saw net profits of QAR 2.07 billion in 2015, an increase of 3.6% compared to the previous year. Group CEO Adel Mustafawi says Islamic finance “has proven to be resilient during challenging economic cycles and has demonstrated strong support for the economy and its customers during challenging phases.”

Furthermore, according to CEO Tamim Al-Kawari, 2015 was a record year for Qatar’s leading investment bank QInvest. “We recorded the highest revenue since inception of QAR 393 million and net profit of QAR 154 million. We have generated consistent performance throughout 2015 despite challenging global economic conditions and regional volatility, culminating in an increase in both revenues and net profit of 32% and 76% respectively. Additionally, we recommended doubling the dividend to shareholders for financial year 2015.”

0 COMMENTS