Since its foundation, J.E.T. has continued to provide tailored and innovative solutions to the world’s leading chip makers.

Could you give us a brief overview of your business? How did it start, and what kind of equipment and services do you supply?

We are a manufacturer of semiconductor cleaning equipment, and we have been working on the development, manufacturing, sales and service of this equipment for the past 14 years. East Asia has been the core of the semiconductor business, and we have had a very good presence in Asian countries in terms of cleaning equipment.

Our forerunner was a company called SES, which underwent a civil rehabilitation process during the semiconductor recession that occurred after the Lehman shock. I used to be a leader in the engineering department, and with the support of a company called Zeus, I was able to take over SES factories and technology and establish JET.

Today, Zeus is our parent company, which is listed in KOSDAQ, in South Korea. Zeus is a maker of manufacturing equipment for semiconductors and LCDs. Also JET has subsidiaries in South Korea, China and Taiwan. Our net sales used to be ¥1.7 billion in 2009, but they have grown to ¥23.1 billion in 2022, which is an average annual growth of 21.7%.

Now I'd like to talk a little bit about the business. The semiconductor manufacturing process is divided into the front-end and back-end processes.

The front-end process makes the designed electronic circuit on the surface of the silicon wafer. The front-end process comprises film deposition, resist coating, exposure, development, etching, implantation of impurities, resist striping and in between these processes, it is required to do the cleaning.

Since semiconductors are highly precise, the cleaning process is quite important, and 30 to 40% of the whole process for manufacturing semiconductors is related to cleaning.

Regarding the cleaning equipment types, there are two types of cleaning equipment. One is the batch type, where 25 to 50 wafers are cleaned at one time, and there is another type which is called the single wafer type, that washes one wafer at a time.

Regarding the characteristics of our batch type cleaning equipment, while the competitor’s equipment such as Screen Holdings’ equipment, are quite standardized, our equipment is easily customized, and you're able to change the configuration and the number of cleaning baths.

Also, for the single wafer type cleaning equipment, we are able to raise the temperature of the chemical solutions on the wafer with an infrared lamp so that we can improve the throughput, and also reduce the amount of chemical solution used.

These are our main products. The latest batch type is the BW3700. We also have HTS-300, which is specialized for high temperature singe type.

BW3700 Series

Japanese companies have large shares, globally, in terms of semiconductor cleaning equipment, and we have held a certain share in this area.

If we look at major players like SCREEN or TEL, the features of these two companies are the manufacturing and sales of standardized manufacturing equipment for semiconductors, which are directed at the global market.

On the other hand, we are not on the same scale as these two competitors, so we targeted South Korea, China and Taiwan, and we have met the customers’ various customization requests.

We have maintained an 11% share in the batch type cleaning equipment.

It was said that the demand for batch type will decrease and the demand for single-wafer type will increase, but the market size of batch cleaning equipment is still growing. If we can respond to the miniaturization and multi-layer wafer production, we believe that the batch equipment market will continue to grow.

We also see emerging competitors in China and they are more focused on the single wafer type, which is standard and easy to manufacture. We think that we can still grow in the batch type equipment market.

Now I'd like to explain about our features and strengths. We have five core strengths. Firstly, a good relationship with Samsung Electronics that we have maintained since the days of our forerunner, SES. We have supplied more than 400 units of cleaning equipment so far over the last 25 years. Since the foundation of JET, we have supplied more than 200 units of equipment.

In particular, they give us an order of the equipment for some processes which are quite intricate. They give the order only to us for that particular equipment. Because once we receive a concern or problem from them, we work together with them to come up with the best solution, and we deliver that solution to the client, and we have maintained this kind of relationship with them.

Secondly, as I mentioned earlier, we have focused on Asia for our international expansion. After 2015, which is one year after “Made in China 2025” was announced, the market in China has been growing a lot. We have also built strong relationships with customers in China.

There is a concern about the United States’ restrictions on exports to China, but that is only for advanced technology areas, and China is continuing investment in legacy areas, so we believe that the recent US export curbs won't have a big impact on our business.

We have 14 offices in China, also the manufacture plant in Korea. We have responded to customer needs with flexibility and agility, so that we have earned more reliability from the customers. This is the third strength.

We can say that the semiconductor industry is a rapidly changing industry, so it's very important to mitigate any impact of the changing economy and market conditions. We are trying to have flexible production capacity, and also trying to turn fixed costs into variable costs.

At the end of 2022, we had about 70 partners including our outsourcers, and we are trying to train and utilize these outsourcing partners by providing the manuals for manufacturing and other instructions. We are trying to share our know-how with these partners, so that we can work together and grow together. I think this is the fourth strength that we have.

Another competitive edge is technical capabilities in niche areas. As you know, wafers are now more miniaturized and multi-layered. Producing these wafers requires the use of chemicals at higher temperatures and higher viscosities, which increases processing times. In order to improve our customers' productivity, there is a growing need for the configuration and number of cleaning bathes installed, and we are able to meet these new needs. I think that's our fifth strength.

HTS-300 semiconductor wafer cleaning machine

We have high sales in China and South Korea. We will start making some efforts to expand to countries other than South Korea and China, so that we can get orders from new markets.

Regarding South Korea, we have started production at a local subsidiary, and we would like to increase the volume of production. Regarding new business orders by co-working with this subsidiary in Korea, previously we used to have a lot of memory related orders, but going forward, we would like to increase the market share for foundry related orders.

In the Chinese market, we established a technical center last year so that we could improve our customer service there, and also increase the number of orders from the Chinese market.

As a new business, we entered the lithium-ion battery field, and we are producing an electrolyte leak checker and an ultrasound welding monitoring system for this area. We also have agribusiness, and we are growing mini tomatoes

I've talked a lot about our focus in Asian markets, but going forward, we would like to expand to North America. We have agreed with Samsung Electronics that we will deliver our equipment to their new plant in Taylor, Texas. With that as the starting point, we would like to start expanding into North America so that we can find new customers there.

One of the key points that you mentioned, in your approach, was having very customized solutions, customized equipment and strength in technology, especially in support of microfabrication. Could you give us an example of a technology or solution that your company offers that none other can, in support of microfabrication?

As for the SPM Clean process, which uses sulfuric acid, the temperature requirement is 120 degrees Celsius or so, and the processing time in each chamber is at least 10 minutes and 20 minutes at the most. HP Clean uses phosphate. The process temperature is between 160 and 165 degrees Celsius, and the time required in each chamber is at least 10 minutes and 60 minutes at the most.

For the single wafer cleaning equipment, you clean the wafers one by one, so if it takes 60 minutes for one wafer in one chamber, then you can only clean one wafer in one hour. It's not efficient, so the cleaning for lower temperatures and shorter time is used for the single wafer type equipment, and the cleaning requiring higher temperatures and more time is used for the batch type equipment.

The basic structure for the batch type cleaning equipment is the same for competitors and us. When we clean the wafers, the wafers flow in from the left side and flow out from the same side. What you mean, wafers come in from the left side, and wafers go back and forth on the transfer line creating a traffic jam, so we can have only eight bathes at a maximum. That’s why throughput is not so high.

Especially as for the other cleaning methods like SPM or HP, which use sulfuric acid or phosphoric acid, the process time is going to be longer. If it takes the chamber with phosphoric acid 60 minutes to complete the process, the throughput is 50 wafers per hour, which is not quite productive enough for the client.

Our F type batch cleaning equipment is what we propose to the client.

With F type, we are able to customize our equipment easily, so we proposed to have multiple baths, say two or three for the phosphoric acid in one machine so that they can be operated at same time. If we have three baths in one machine, and if we can operate them at the same time, then we can clean one lot, 50 wafers, every 20 minutes. It is three times more productive.

Also, we are able to put up to 14 baths in F type batch cleaning equipment. We can make wafers flow only one way, getting in from the left side and getting out from the right side with no congestion. Although this chart shows 10 baths, we are able to put in up to 14 baths. In this way, we have more flexibility in equipment configuration, which is our strength.

We can customize our equipment by taking customer requests such as what application to be created to address their needs, what chemicals they would like to use, and what throughput they would like to achieve into consideration.

Customers are able to provide us with their requirements regarding the processing time and the chemicals. However, they are not able to come up with the ideal throughput. So based on their request we suggest one configuration of process at first, and if that doesn't meet the customer's request then we are able to customize our equipment so that we can meet the customer’s request and we are able to flexibly change the order and the number of baths that the machines will use.

For example, in the manufacturing process for DRAM and flash memory at one of our customers, only our SPM cleaning equipment is currently being used.

Now they are facing other competitors, but they are able to continue to be profitable even in this tough situation because they have a very good ability to absorb costs by reducing the cost of sales. That's why they have been the top maker of memory, and our equipment is contributing to the cost efficiency for this company.

Can you tell us more about the circumstances surrounding your recent initial public offering?

We started preparing for this application five years ago, and in 2021, we were successfully listed in the Tokyo Stock Exchange Pro Market, and now we are in the process of changing the market to the Tokyo Stock Exchange Standard Market.

When we started as JET, we had 110 employees, and that is inclusive of some core management members like myself and some other board members. In order for this company to grow going forward, we believed that we needed to build up teamwork rather than rely on the capabilities of a few core individuals.

That's why we started the IPO process, because through the IPO, we would like to enhance our brand recognition so that we can attract more talent. Comprehensively, we would like to grow as a company, so that is the ultimate goal of the IPO. If you're just looking for more investment through an IPO, this would be the worst timing. This IPO is not for raising funds.

Could you tell us a little more about the role that collaboration and co-creation plays in your business? Specifically, if you're looking for any new partners, especially with overseas companies. Is that something you're pursuing in this next stage?

In 1988 I joined this company and entered this industry, so I've been in this industry for 35 years. Back in that year, Japan was a leading nation in terms of the semiconductor field. At that time, South Korea was far behind Japan in semiconductor manufacturing technology, and 1988 was the year when the Seoul Olympics were held.

I went to South Korea around that time. South Korea started learning about semiconductors from Japan, and the center of this particular industry moved to South Korea. Now, Taiwan is the leading region for semiconductors. The landscape is such that China may take the dominant position in this area going forward.

Japan’s position in Asia for the semiconductor field has changed during this time. I've seen the change in Japan’s position. When it comes to manufacturing, our stance has been to procure the materials and components in Japan, build the equipment and to sell it to overseas markets.

That approach has remained unchanged, but as the Japanese position in this industry has declined, I've noticed that Japanese partners, especially subcontractors in the automotive industry or the machine tool industry, have had the leading capabilities in terms of their ability to procure high-quality components and units at a cheap price.

In this area, Japan has led all other Asian countries. However, the weakness for these subcontractors is that they are not able to assemble these components and sell them as one product, so what we want to achieve with these partners is to work together with them so that we can put together one product with these high-quality components, and sell that product.

Our approach, therefore, is not to look for the cheapest components, but we are looking for a partner who has the motivation to work together with us for a new business model, even without experience in that area. Once we find that kind of good partner, we don't mind sending our employees to their factory so that we can provide training for them.

Then, once they are able to start making the product, we will start the training for the manufacturing as well. These companies are not just our subcontractors, they are true partners, and I think that is our strength.

Let's say we come back to interview you again in six years' time for your company’s 20th anniversary. What would you like to tell us about your goals and dreams for the company in that timeframe, and what would you like to have achieved by then?

First of all, we would like to create a market in the US. We would like to have market share in the US, and also, we would like to revisit the domestic market as well. We are a Japanese manufacturer, but we don't have any sales staff or sales operations in Japan, which is very unique, but we would like to revisit the Japanese market so that we can create a certain position there.

As I mentioned earlier, we would like to work with a partner in the US so that we can expand there, and we would like to start that initiative this year.

Also as I mentioned, since we are aiming at an IPO, we would like to continue to grow as a company for stakeholders as well. To that end, we would like to attract good talent to this company so that we can grow as a team, not just by a few core individuals, so that we can continue making new developments. We would like to establish that kind of structure.

I’ve seen the historical trends for the semiconductor field, and what position Japan has taken in this field over time, as well as the other countries like South Korea, Taiwan and China. Personally, I think that the reason why Japan failed to achieve a certain position in this field is because they failed in the PDCA cycle.

The PDCA cycle is often set as a cycle for development, but Japan failed at the ‘P’ stage – the planning stage. Although people came up with different plans, and they discussed them, they never made a decision to pick one of these plans, so Japan doesn’t have a lot of ‘D’s (do).

On the other hand, in other countries like South Korea, Taiwan and China, they start from the ‘D’. They just do, from the very beginning. It might succeed or fail, but through deeds they are able to learn know-how, and then they move on to C, A and P.

However, in Japan, we failed at the ‘P’ stage, so we don't have a lot of accumulation of lessons learned through deeds and doing things. As a development oriented company, I think that the cycle should start with ‘D’.

Regarding the term “risk”, it's origin is Latin which means “to try with courage”. Once you have an idea, you should just try. That's the philosophy of this company. You should try, and if you fail then you can learn from that. You can learn more know-how. If you succeed, then you can have success and good practice. I think that's going to be a philosophy deeply rooted in this company.

Addition by JET

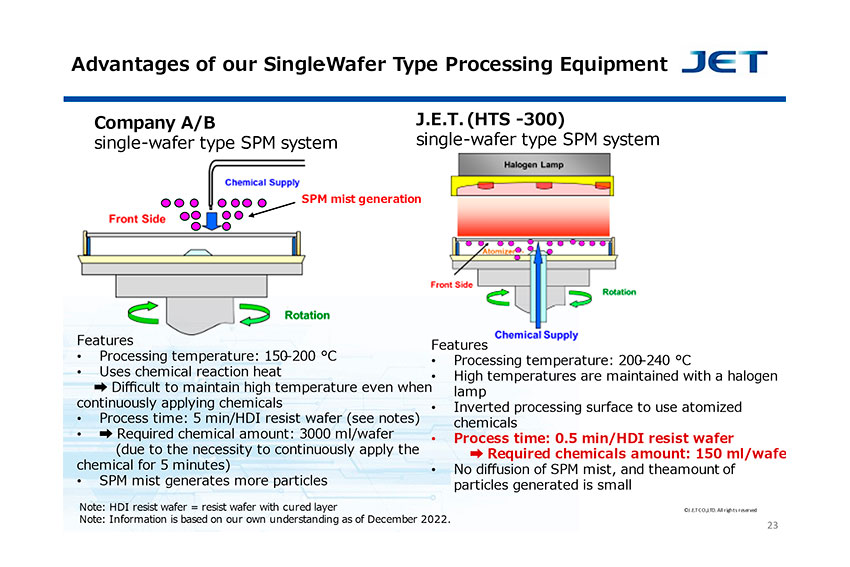

We will explain the advantages of our single-wafer cleaning equipment (HTS-300).

The feature of our single-wafer cleaning equipment is not only that it supplies high-temperature chemicals, but also maintains the temperature by heating it from the back of the wafer with a halogen lamp. In addition, the wafer treatment surface is turned upside down and chemicals are sprayed and supplied to the treated surface.

As a result of these measures, the processing time of resist wafers with a cured layer can be reduced to 0.5 minutes and 1/10 of the 5 minutes of competitors.

As a result, the amount of chemicals used to process a single wafer can be 150 ml, which is one-twentieth of that of our competitor's 3,000 ml, which requires continuous supply of chemicals for 5 minutes, while our equipment sprays chemicals and supplies them for only 30 seconds.

In addition, when chemicals collide with other companies' equipment, SPM mist is generated when wafers and chemicals collide, and particles (fine debris) remain in the mist, which may adversely affect process processing. Since our equipment supplies chemicals in the form of a mist to a wafer with the processing surface facing down for a short time of 0.5 minutes, the generation of particles that adversely affect process processing is reduced.

0 COMMENTS