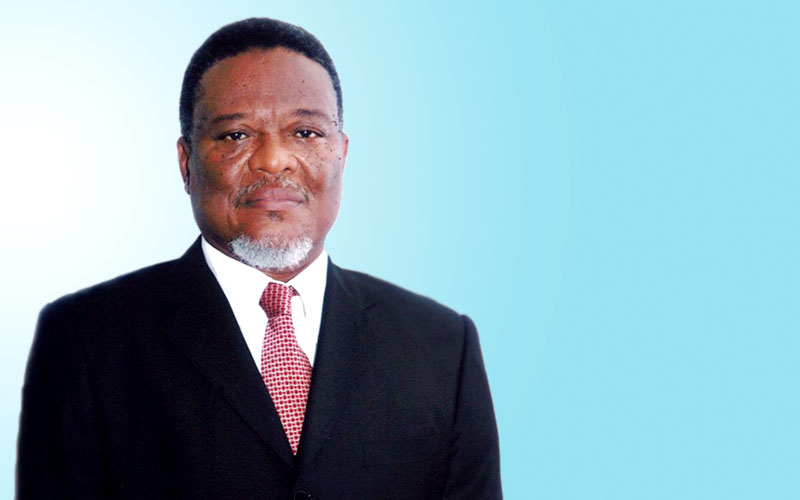

The prime minister of Guyana, H.E. Samuel Hinds, pointed out to the United World team what is moving the country forward and Guyana’s strategies for further developing trade.

Guyana is going through a truly exciting time at the moment in a period of global economic recession. Guyana has been one of the top 5 fastest growing economies in Latin America, and has even projected to boast an impressive growth of over 5% GDP for 2014. What would you say has attributed for this impressive economic growth?

We had a pretty serious flood in 2004 as we received extreme rainfall during that year. From Christmas to January of 2004, much of the coast was in calamity to some degree and for about 2-3 months onwards. During that period, the country came together. I remember the President at the time, Dr. Jagdeo, gathered all the ministers and all along the coast we participated in helping with the distribution of food hampers, and tried to get people into shelters. After that, we focused on our recovery. We’ve had continuous growth from that time. The first stage was recovery, but a number of fortunate things also happened. Gold prices were rising. Small and medium scale Guyanese miners were receiving good money for their efforts in recovering gold from the hinterland. Larger companies prospected quite a bit spending money in the hinterland. There was also enthusiasm in the hope of finding oil off the coast of Guyana. I believe the USGS in one of the global reviews in the 1990s had suggested that there may be a pool of petroleum resources off the coast of Guyana and Suriname. That helped create interest, so this was leading to the drilling that eventually took place along the Guyana coast (French Guiana, Suriname and Guyana) from 2009 to 2012.

In addition, there was demand for rice, and prices for rice were quite high. All of these factors came together and that has given us a period of growth, which I hope snowballs. Success tends to lead to more success. We are hoping that that growth will continue. We’ve had growth with outsourcing. We’ve had some interest in offshore schooling in medicine. Students come here from Africa and India. Many students are local Guyanese as well. We hope that growth can be sustained in the air industry- in flying schools and aircraft maintenance. We do have a local aircraft maintenance and pilot school. They do attract some support from Caribbean Airlines and LIAT in terms of students.

We’re looking to refashion our sugar operations. They had been receiving prices higher than the world prices. Around 2008-2009, these special preferential prices, a legacy from the days of Colonialism, came to an end, which resulted in a 36% reduction in prices. That has made quite an impact as sugar prices were quite high for some time.

Guyana has always led the fight for global climate change, and is in fact leading the way with your Low Carbon Development Strategy (LCDS). Do you hope other countries will emulate your policies? Is your strategy to lead by example?

The LCDS was advocated and developed by the President at the time, Dr. Bharrat Jagdeo. He is the leading member of a number of environmental groups at the world level. I don’t know if he’s still the President of the Global Green Growth Initiative, which is centered in South Korea, and I think he may also be involved with some UN groups looking to finance programs for green growth and climate change.

But you’re involved in the strategy as well, if I’m not mistaken?

Yes, I am involved in the LCDS. Traditionally, countries in the course of development have had to utilize their forests as a source of materials which brought work opportunities and income. Guyana and other developing countries, which still have forests, should still get some reward or assistance to avoid going down that road. If they do go down that road, it should be tread in a sustainable way. The LCDS said, basically, that there would be growth, that growth is a given. People want to develop. Development historically has utilized forests, and if they are to forego or helped to forego that utilization, they should receive some rewards for not utilizing their forests in an unsustainable way. And that reward would help them develop other things. For example, tourism is being promoted- hydropower, alternative energy, and support for renewable energy.

Speaking of energy, I’ve read that the unavailability for cheap and reliable energy could be one of the biggest hurdles holding Guyana’s development back. Would you agree with this?

Anybody blessed with cheap energy would not refuse it. I learned in school a long time ago that different places have different advantages, natural advantages and disadvantages. It just so happens that we have the potential of hydro power. But that has had a lot of hurdles to get over. Financing has been an issue, and financing in a way that is not too costly, and environment impact assessments have been an issue. The road to get there has been an issue. Many of the financial institutions that one would look to work with- the Inter-American Development Bank (IDB), for example, have had great concern with the hydro and particularly with the road that leads to the site for the hydro development.

So you’re looking for financers for this project?

We have worked for 5-10 years to put things together. We had to find financing that is concessionary.

We have worked to acquire financing that is concessionary to keep the rates low. We have worked with Sithe Global, an American company, a subsidiary of the Blackstone Group, and we have a commitment of about 50% of financing from the Chinese Development Bank.

This is currently going on?

In 2012 or so, we were hoping to proceed to the next phase of execution. The other parties in Parliament were not supportive. Sithe Global stated that for large projects such as this, their policy required all political parties in a given country to be supportive as these are projects that last for 20-30 years. That more or less has put a bit of a stall on this initiative, although we think we can now proceed. We are about to make another effort to make the Amaila Falls Hydropower Project finally happen.

So this is one of your top priorities. If I’m not mistaken, you’re in charge of energy as well. So this must be your baby as it will revolutionize the economy.

Yes, it would greatly transform the economy to have a large hydro power plant.

Guyana is the only English speaking country in Latin America, and because of that is a natural gateway for American companies who want to invest in not only Latin America but South America. So how is the government working to harness all of your attractive attributes and attract these investors and companies to set up operations in Guyana?

We’re working on completing a paved road from Georgetown to Manaus. That would be quite a link and indeed that idea hails from the 1920’s when Henry Ford acquired a large area in the Amazon to establish a rubber plantation. He proposed to bring his rubber through more or less the same route from Manaus to Boavista to Georgetown, then by ship to the USA. 225 miles of 800 miles of road need to be paved. We’ve been in discussions with the Brazilians about how we can get that section paved. That’s why we hope there would be this road link from Manaus on the Amazon River, a city of 2 million, down to Georgetown. Much of Brazil’s development and industry has been in the south of the country. However, there are plans to develop northern Brazil. Guyana would fit readily into serving the development of northern Brazil. It would be a natural port; a port for northern Brazil on the Guyana coast.

Is this something in the pipeline?

This has been discussed for some time, and we are working on it. But many pieces must come together to make this a reality.

Do you see Guyana’s diplomacy evolving? Over your 25 years as Prime Minister, have you seen Guyana playing a more strategic and instrumental role in developing this sector of the world?

Our former President, President Cheddi Jagan, developed a position paper called the New Global Human Order, which has been adopted in the UN. This basically advocates a position that developing countries can work together with developed countries for mutual interests for the development of all parties. I would say that is our background position. We have opened our doors to the whole world from whichever point interest comes and wherever there’s a good fit to a sufficient extent. For the US and Canada, outsourcing has been heavily promoted. We’ve had some limited success with Qualfon and other call centers in Guyana.

So there has been a lot of American involvement and further potential.

Yes, we are still open but I think the people who are investing now are people from Asia; China, India, and Malaysia. They are the larger investors in terms of quantities, or monies. However, whosoever comes will be welcomed. Everyone is eligible for the same treatment-there are standard incentives for any company to come to Guyana to work.

I think that’s true. The Chinese have a massive appetite for natural resources, but I think the strategic shift of American interest to Latin America is tangible especially in the last couple of years, especially with President Ramotar going to the UN just last week.

And we will welcome them. We do have close contacts with the US and Canada, historically and in terms of people’s family members of Guyana who are in the US. That’s a contact there. We’re hoping we’ll see a boost in tourism particularly. The distance is not that large. Maybe 4 hours from Miami. Maybe 3-4 hours direct flight from Miami, 5 hours direct flight from New York, and 6 ½ hours from Toronto.

So what advice would you give to all our US readers who will be reading this report, to US investors who are interested in investing in Guyana? How should they go about doing that? Or what opportunities would you like to highlight?

I think tourism is definitely one of them. We have an American telephone company that bought the government monopoly telephone operator in the 1990’s, one of the smaller telephone companies of the US, ATN, Atlantic Tele-network. It was bought on privatization about 1989 and it has done extremely well for its investors.

So last year alone 185 billion dollars was invested into Latin America, and yet less than 1% of that has made it into Guyana. So why Guyana? Why should investors increase?

Our population and economic size is one constraint to our development. In order to develop further, we need to rely on exports as local Guyanese markets are not enough. There has been interest in Guyana for its natural resources, which traditionally have been timber, mining, and petroleum potential. Companies prospecting offshore of Guyana include ExxonMobil, Repsol, and CGX. Another area of development is Guyana’s tourism sector. A government company is leading this investment, leading in the construction of the Marriot Hotel. The proposal assumes that once commercial operations begin, other investors would be attracted to buy it out. We took the risk, because building a new hotel like that in Guyana might encounter some concerns. We welcome offers to buy it. I think the total cost might be in the order of 40 million US dollars. They are looking for someone to take the equity.

During this illustrious career, what have been your biggest accomplishments or milestones?

Government is a team effort, and one plays as a member of the team. But I will say that my main areas of responsibilities until 2011 have been in mining, and to some extent petroleum, and electricity. I would say one of my main accomplishments is helping to put in trails in our hinterland-to Mahdia, to Lethem, to the Southern Pakaraimas. For example, now one can drive from Georgetown to Lethem along a laterite surfaced road, which couldn’t be done twenty years ago. Another milestone has been our success in opening up the country, working with the miners and the foresters, and connecting the country through building trails connecting small communities and places in the hinterland.

Thank you very much.

0 COMMENTS