Morocco’s automotive industry has shifted into top gear, experiencing double-digit growth, with exports of cars up 90% so far this year

Demand for the Sandero, one of Renault subsidiary Dacia’s top selling cars, has skyrocketed in Europe. Sales of the hatchback along with Dacia’s other top-selling model, the Duster SUV, sparked a 24% increase in the company’s sales in the region in the first half of 2014.

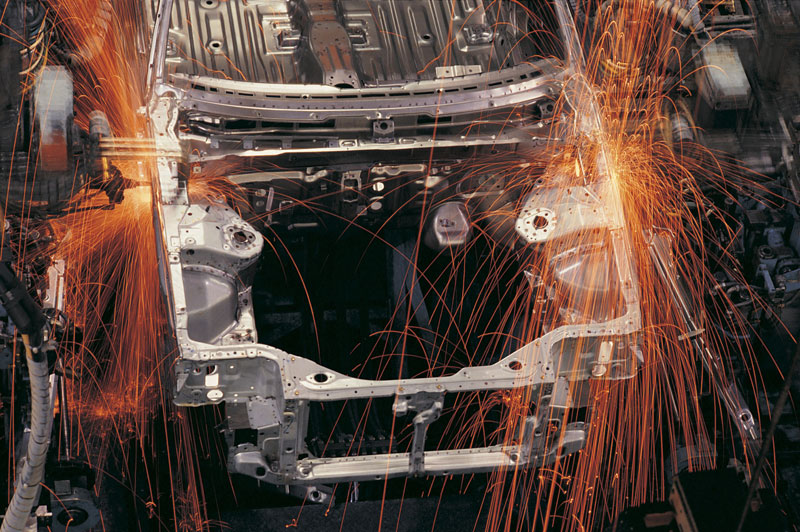

To keep up with growing demand for the hot-selling hatchback, Renault announced last year that it would increase production at its Tangier plant in Morocco to 400,000 vehicles a year in the coming years, up from 200,000 in 2013 and 60,000 in 2012, when it opened the factory at a cost of $1.5 billion. Recently, Europe's third-largest carmaker said it is considering shifting production of engines to Tangier. "We are thinking about it, but we first need to have a stronger supply chain on the ground," Renault CEO Thierry Bollore said at an auto show in Paris earlier this month.

Renault is not the only automotive firm investing in Morocco; an expanding number of carmakers and parts suppliers have established themselves in the kingdom, including U.S. company Delphi, a global supplier of electronics and technologies for the automotive industry.

Multinationals have no doubt been attracted by Morocco’s political stability; its close proximity to Europe; its free trade agreements; its cheap, yet capable, workforce; and the financial and tax incentives that are available to them at sites such as Tangier Automotive City, a thriving business hub which makes up part of the larger Tangier Free Zone industrial complex. (The growing attractiveness of Morocco was reflected in the recent Wall Street Journal Frontier Markets Sentiment Index, in which the country jumped from 12th to 6th, seeing the most positive change in sentiment, along with Tunisia.)

As a result of increased investment and growing demand, Morocco’s automotive sector is experiencing double-digit growth. Automotive exports grew 34% year-on-year in the first eight months of the year. Car exports alone have risen 90% so far this year, following 70% growth last year. The rise in auto exports has no doubt been helped by Morocco’s free trade agreements (FTAs). The kingdom has FTAs in place with the EU, Jordan, Egypt, and Tunisia; and it is the only North African country to have an FTA with the U.S.

The shift into high gear in the automotive sector will help to push GDP growth up 4.5 to 5% in 2015-2016, up from 2.5% in 2014, according to Capital Economics, a leading economic research consultancy, which, it said, would make Morocco “North Africa’s best performing economy over the coming years.”

As well as pushing up GDP, the kingdom’s burgeoning automotive sector will help to push down the unemployment rate, which currently stands at around 10%. Renault and Delphi provide employment to more than 6,000 workers. The total number of workers in the industry will continue to rise as these companies expand operations and more firms enter the market. As the industry grows, it will also help to strengthen social stability by employing many more young Moroccans. Youth unemployment was one of the main issues that sparked the Arab spring protests that severely affected other countries in the region three years ago.

Companies such as Renault are not just providing employment at their factories; they are also supporting a thriving SME sector. The production of Dacia Sanderos is only the “visible part of the iceberg. There is a whole range of SMEs working in this sector—suppliers for Renault in Tangier—and also huge exports of parts for factories in Europe,” Mamoune Bouhdoud, Morocco’s minister delegate for industry trade investment and the digital economy, said recently. More than 40% of the parts that make up Renault’s Moroccan cars are sourced from local suppliers. And if the company does decide to move engine production to Tangier, Moroccan SMEs could be the link in the stronger supply chain that the Renault CEO says is required to make the move.

Morocco has quickly become a regional automotive hub and an attractive investment destination for the big players in the industry. The kingdom has ambitious plans to become a global leader in automotives. Judging from the staggering growth of the industry since 2012, it is well on the road to achieving that goal.

by Jonathan Meaney, Worldfolio staff writer

0 COMMENTS